Category: Blogs

25 Years of Trust, Discipline, and Process: From Chartered Accountancy to Building AKCJ Capital

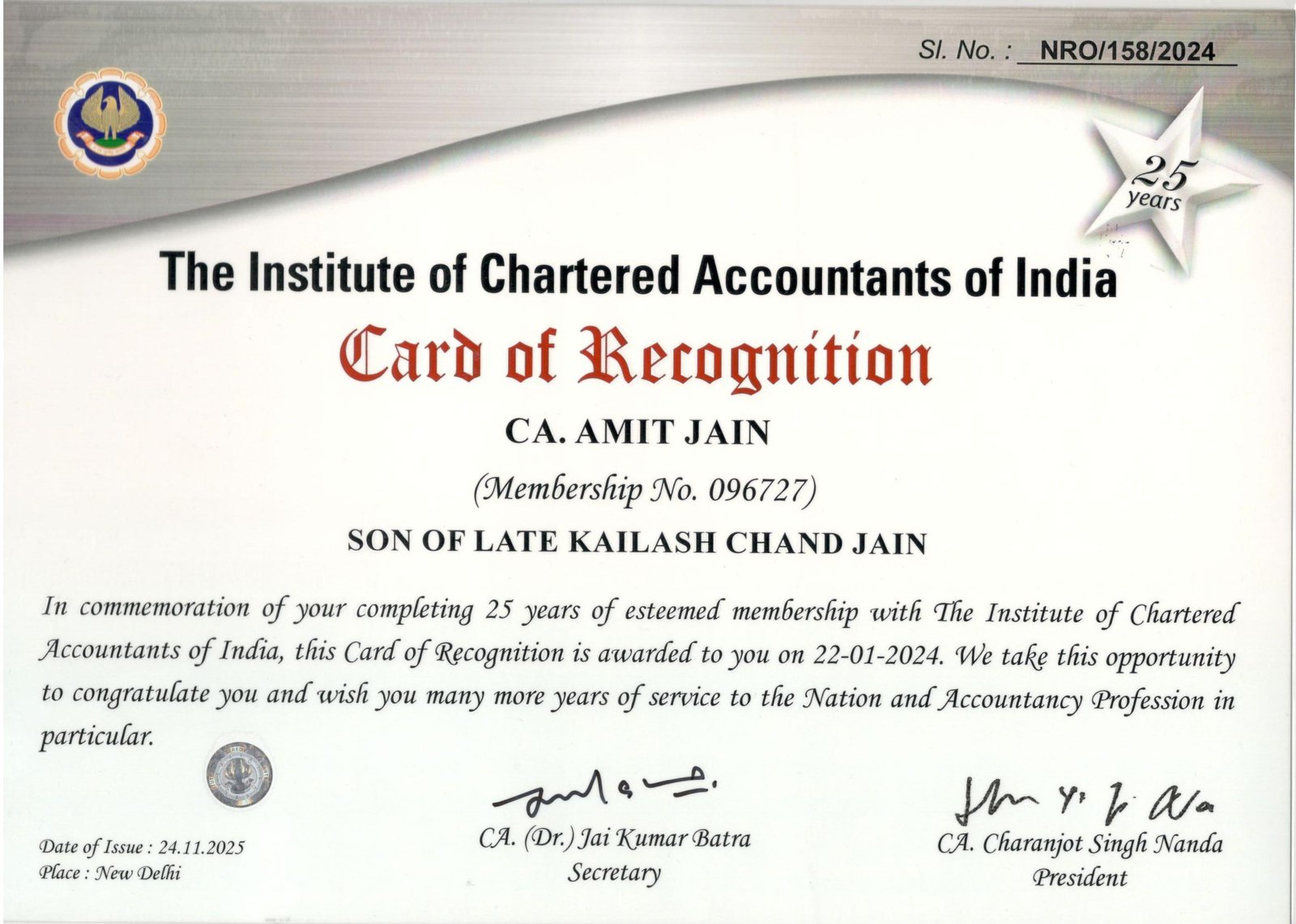

I am privileged to have received the “Card of Recognition” from the Institute of Chartered Accountants of India (ICAI) in recognition of 25 years of membership. I express my sincere gratitude to ICAI and to all those who have supported and accompanied me throughout this professional journey.

India’s Union Budget 2026: Strategic Outlook for Investors

The 2026–27 Union Budget of India arrives at a crucial inflection point — an era where growth momentum remains robust, but macroeconomic headwinds and evolving global trade dynamics pose both challenges and opportunities for markets and investors.

Why Asset Allocation Matters More Than Fund Selection

When investors think about mutual fund investing, the first question they usually ask is, “Which is the best fund?” Rankings, recent returns, and star ratings often dominate decision-making. While fund selection has its role, focusing on it alone can be misleading. Over long periods, investment outcomes are influenced far more by asset allocation- how money…

Indian Family Office Models: Your Place in the Long-Term Capital Landscape

India’s family office ecosystem is expanding rapidly—but not uniformly. Some families are building capital for continuity across generations. Others are still deeply anchored in founder-led conviction. Many are navigating the complex transition between the two.

Why Indian Promoter Wealth Rarely Survives Three Generations

India has created a remarkable number of wealthy promoter families over the past few decades. Liberalization, access to capital, and entrepreneurial risk-taking have produced significant private wealth across manufacturing, real estate, infrastructure, pharmaceuticals, and services.

Designing Portfolios for Usability, Not Just Valuation

In wealth management, portfolios are often evaluated through returns, benchmarks, and asset allocation. While these metrics are essential, they address only one dimension of financial success. The more critical, yet frequently under-designed, dimension is liquidity and cash flow planning—the ability of a portfolio to reliably fund life expenses across market cycles without compromising long-term capital.

Not All Money Has the Same Job: Why One Portfolio Can’t Serve Your Entire Life

Most investors are familiar with asset allocation – how much to invest in equity, debt, or cash. Yet, while learning and engaging with different perspectives on wealth management, one insight stands out clearly: many investors feel uneasy about their finances not because returns are poor, but because different expectations are placed on the same pool…

Family Offices in India: Structural Shifts, Strategic Transformation, and the Road Ahead

Family offices in India are undergoing one of the most significant transitions in their history. Once designed primarily as custodians of family wealth, they are now emerging as institutional-grade platforms that integrate governance, capital allocation, technology, and purpose. This evolution is closely linked to India’s rapid wealth creation cycle and a landmark intergenerational wealth transfer…

How to Evaluate an Investment Opportunity

Evaluating an investment opportunity goes beyond numbers and hype. It requires understanding the business model, growth potential, risk factors, market positioning, and long-term value. This expert-led guide breaks down how to assess opportunities logically, balance returns with risk, and make informed decisions aligned with your financial goals and investment horizon.

Is the AI Boom Already a Bubble? A Hard Look at Valuations, GPUs, and the Trillion-Dollar Warning Signs

In mid-2023, Inflection AI – the startup founded by DeepMind co-founder Mustafa Suleyman – raised $1.3 billion at a valuation near $5 billion, despite generating less than $10 million in revenue. At the same time, it committed to buying 22,000 Nvidia H100 GPUs valued at nearly $1 billion – more than its entire lifetime revenue.