Designing Wealth Architecture and Governance for Families That Plan Beyond Generations

Engagements are selective. Alignment is essential.

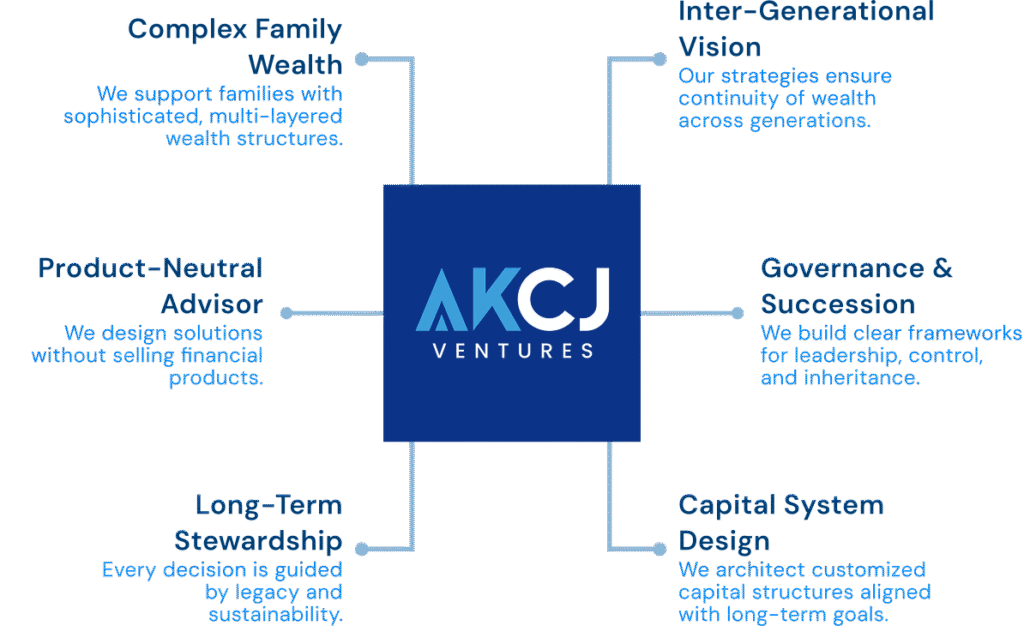

Design the Undesigned

Redefining legacy businesses by designing structure, governance, and clarity—so trust and continuity endure across generations.

AKCJ’s thinking is shaped by deep experience across finance, law, and global leadership frameworks, informed by continuous engagement with international academic and practitioner communities.

Amit KC Jain is the Founder and Managing Partner of AKCJ Ventures LLP and AKCJ Capital, leading an integrated ecosystem that spans multi-family office advisory, comprehensive wealth management, financial planning, family office setup, succession and estate strategy, family settlements, and strategic business advisory, including mergers and acquisitions.

A chartered accountant, law graduate, and alumnus of The Wharton School, Amit brings nearly 30 years of deep experience across wealth creation, long-term financial planning, legal-tax structuring, compliance-driven advisory, and generational wealth preservation.

Through AKCJ Ventures (Multi Family Office Advisory and Strategic Business Consulting) and AKCJ Capital (Wealth Advisory), Amit helps affluent families, business owners, and professionals transition from ad hoc decision-making to well-designed and disciplined wealth architecture. His approach integrates asset allocation strategies, liquidity planning, estate structures, succession roadmaps, and family governance—ensuring every financial choice is aligned with purpose, legacy, and long-term stability.

Connecting what is, with what truly matters.

Amit KC Jain

Founder and Managing Partner

Inside Our Firm

Navigate through the sections that shape our values, services, and vision.

Our Services

Discover service excellence. We craft tailored solutions to meet your unique needs and fuel success.

Multi Family Office Advisory

We architect comprehensive wealth blueprints covering asset allocation, liquidity planning, and long-term capital structure.

Strategic and Business Advisory

Driving operational excellence and enterprise growth. Enabling family offices, founders and promoters to navigate pivotal decisions.

Our Philosophy of Stewardship

Who We Work With

Growth and transition

Business Owners & Next-Gen Wealth Creators

Entrepreneurs, founders, professionals, and inheritors who have built or realized significant wealth and now seek structured diversification and long-term capital strategies.

Cross-border wealth needs

Global Indians & Cross-Border Families

NRIs and families with international income or assets who require India-focused wealth management, governance, and regulatory compliance support.

Long-term preservation

Legacy Families & UHNIs

Ultra-high-net-worth families focused on succession planning, continuity, and preserving wealth across generations.

Growth and transition

Business Owners & Next-Gen Wealth Creators

Entrepreneurs, founders, professionals, and inheritors who have built or realized significant wealth and now seek structured diversification and long-term capital strategies.

Cross-border wealth needs

Global Indians & Cross-Border Families

NRIs and families with international income or assets who require India-focused wealth management, governance, and regulatory compliance support.

Long-term preservation

Legacy Families & UHNIs

Ultra-high-net-worth families focused on succession planning, continuity, and preserving wealth across generations.

How We Work

We do not sell products or chase short-term performance.

We are not brokers, product distributors, or transaction-led advisors.

Retainer-based, conflict-aware advisory with full transparency

Selective client engagement for high-quality outcomes

Long-term partnership mindset

Understanding wealth as more than assets—an interconnected whole.

At AKCJ Ventures, we don’t just advise—we architect, align, and steward long-term outcomes. Whether designing multi-generational legacies for families or guiding strategic transitions for businesses, our approach is deeply strategic, multi-disciplinary, and rooted in trust.

01

We Listen First

Every engagement begins with deep listening. We understand your story, aspirations, and pain points—so we can tailor solutions, not templates.

02

We Diagnose with Depth

Through financial, legal, and strategic lens, we map challenges, uncover opportunities, and identify structural gaps others often miss.

03

We Design for Scale

From capital strategy to governance frameworks to M&A transitions—we build actionable, future- ready plans with precision.

At AKCJ Ventures, we help families and enterprises navigate complexity across wealth, governance, strategy, and transition. Our multi disciplinary expertise brings clarity to decision-making, discipline to execution, and confidence at critical moment —enabling progress with purpose and precision.

04

We Execute with Accountability

We don’t just hand over a strategy—we walk with you. Our team stays involved through implementation, ensuring timelines, impact, and outcomes are achieved.

05

We Think Long-Term

We’re not here for short wins. Whether it’s preserving family legacy or scaling your business—we build for sustainability, succession, and success that lasts.

An Integrated Approach to Strategic Value

Strong Governance and succession design

Clear Capital allocation

Integrated Legal and tax structuring

Disciplined Risk and liquidity intelligence

Your Partner in

Vision, Value, and Legacy

At AKCJ Ventures, we help you navigate complexity across wealth, strategy, capital, and growth. Our multidisciplinary expertise ensures clarity in decision-making, strength in execution, and momentum where it matters most. From strategy to scale, we’re here to help you move forward—with purpose and precision.

Testimonials

Manish Kapoor

Chief Financial Officer, Hughes Systique

"What stood out most about AKCJ Ventures was their command over complex tax and compliance matters—and the urgency with which they act. Amit and his team are not just strategic thinkers, they’re relentless doers. They brought structure to our regulatory landscape, resolved issues swiftly, and ensured we were future-ready without unnecessary delays. Their go-getter mindset, combined with deep technical knowledge, makes them a rare and trusted ally in today’s dynamic business environment."

Sanjiv Jain

Managing Director, Prime Polymart Private Limited

"Partnering with AKCJ Ventures has been a turning point for our company. Amit and his team brought a strategic lens to our business that helped us think beyond day-to-day operations and focus on long-term value creation. Their understanding of family-run businesses, financial structuring, and growth readiness is exceptional. What stood out most was their ability to blend sharp advisory with genuine care. They were as invested in our success as we were. AKCJ doesn’t just guide—they empower, and that makes all the difference."

Avdhesh Maheshwari

Founder & Managing Director, Panchvaktram Engg. Pvt. Limited

"AKCJ Ventures played a key role in structuring our contracts and navigating international agreements with clarity and precision. Their understanding of cross-border compliance, coupled with a strategic business lens, made them invaluable to our global expansion efforts. With AKCJ, we found not just legal advisors, but true partners in growth."

Sumit Katyal

Proprietor, Starky Solar International

"Transitioning from a trading setup to a full-fledged manufacturing business is complex—but with AKCJ Ventures by our side, the journey became structured, strategic, and far more confident. Amit and his team brought clarity in decision-making, helped us navigate legal, financial, and operational restructuring, and aligned everything with our long-term vision. Their support went beyond advice—they truly became partners in our transformation."

Puneet Jain

Managing Director, Elasto Textiles Private Limited

"Working with AKCJ Ventures has felt less like hiring an advisor and more like gaining a trusted partner. Amit and his team took the time to truly understand our business, our values, and our long-term goals. Their guidance wasn’t limited to numbers or structures—they brought clarity during key decision-making moments and stood by us when it mattered the most. As a family business, that kind of empathy combined with expertise is rare to find. With AKCJ, we didn’t just plan our growth—we built confidence in our future."

Our Commitment

The firm is designed to function as an institution—not as an individual-dependent advisory practice. We will never recommend any action that benefits us at the cost of a client’s long-term outcomes.Trust is our most valuable asset.

Frequently Asked Questions

This FAQ section includes frequently asked questions that can help provide clear and concise answers to your questions.

AKCJ Ventures is an integrated family office and strategic advisory firm that partners with families, business owners, and enterprises to design, protect, and transition wealth and businesses across generations. Unlike firms that operate in silos pure consultants, standalone M&A advisors, or product- led wealth managers—AKCJ Ventures works across the entire decision ecosystem of a family or enterprise. We combine multi-family office advisory, wealth strategy, succession and estate planning, family settlements, and strategic business advisory including mergers and acquisitions under one unified framework. Our role is not transactional. It is long term, contextual, and continuity-driven.

AKCJ Ventures works with Indian business families, promoters, and UHNI clients where wealth is complex, inter-generational, and deeply linked to governance, succession, and long-term decision-making.

We are best suited for families who value:

• Discipline over speculation

• Clarity over noise

• Continuity over short-term performance

We are not designed for transactional investors or short-term return seekers.

Yes. Governance and succession are central to our work.

We help families design:

• Decision-right frameworks

• Family governance structures

• Succession pathways

• Next-generation capital readiness

Our focus is on continuity—not just transfer.

Our consulting isn’t just theoretical. It’s embedded in operational realities. We help businesses scale smartly—validating models, optimizing performance, navigating regulatory environments, and future-proofing growth.

Our core engagements are retainer-based, not transaction-driven.

Depending on the scope, we may also charge:

• Advisory fees for capital allocation and governance work

• Fully disclosed execution income, where applicable

Our pricing is designed to preserve independence and avoid conflicts of interest.

Yes—and in many cases, we prefer it. AKCJ Ventures often acts as the integrating layer, ensuring that:

• Advice is consistent

• Decisions are aligned

• Roles are clearly defined

• Conflicts are managed

We do not replace specialists; we orchestrate them.

Very selective. Every engagement begins with a philosophy and alignment discussion.

If we believe expectations, timelines, or values are misaligned, we may respectfully decline the engagement.

We begin with a private, exploratory conversation. This is not a sales discussion. It is a mutual evaluation of alignment, complexity, and long-term fit.