25 Years of Trust, Discipline, and Process: From Chartered Accountancy to Building AKCJ Capital

January 30, 2026

CA Amit KC Jain

Founder & Managing Partner

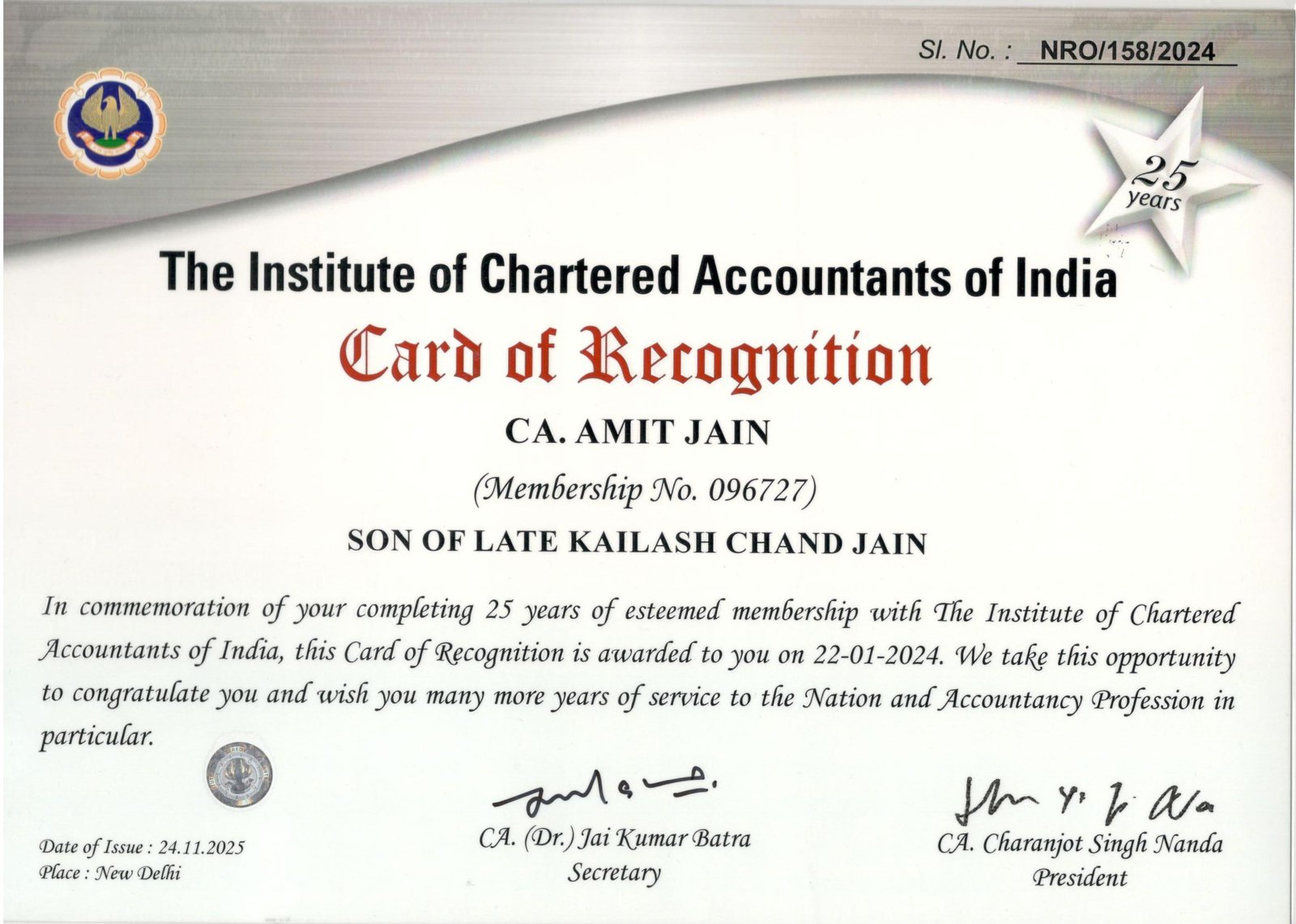

I am privileged to have received the “Card of Recognition” from the Institute of Chartered Accountants of India (ICAI) in recognition of 25 years of membership. I express my sincere gratitude to ICAI and to all those who have supported and accompanied me throughout this professional journey. This milestone is not just a measure of time, but a reflection of qualification, experience, discipline, ethics, and credibility—values that form the very foundation of my professional approach and have directly shaped the philosophy behind AKCJ Capital.

The Chartered Accountancy profession instils a strong grounding in financial discipline, governance, risk assessment, compliance, and long-term thinking. Over 25 years of professional experience—working closely with individuals, professionals, entrepreneurs, and business families—has reinforced a simple but powerful insight: Sustainable wealth creation is less about products and more about process, discipline, and alignment with financial goals.

It is this perspective that led to the establishment of AKCJ Capital, an AMFI-registered Mutual Fund Distributor (MFD), designed to facilitate mutual fund investments through a structured, transparent, and process-led wealth management framework, aligned with regulatory expectations and best practices.

AKCJ Capital: A Disciplined, Process-Led Approach to Wealth Management

In an increasingly complex financial environment, effective wealth management requires more than access to investment products or short-term market views. It requires a clearly defined process, consistency, documentation, and regulatory adherence.

Why AKCJ Capital Entered Wealth Management

Through years of engagement, it became evident that many investment decisions were often made without:

Clearly defined financial goals

A documented financial plan

Periodic review and monitoring mechanisms

While investment products are widely available, process-driven guidance and disciplined execution remain limited.

AKCJ Capital was established to bridge this gap—by enabling investors to participate in mutual fund investments within a goal-aligned, documented, and review-oriented framework.

Our Process-Oriented Wealth Management Framework

At AKCJ Capital, the role of a Mutual Fund Distributor goes beyond transaction facilitation. Our approach emphasises discipline, suitability, transparency, and continuity, in line with AMFI and SEBI guidelines.

1. Goal Identification

Structured discussions to understand financial objectives, time horizons, and risk considerations—providing direction and suitability.

2. Financial Planning

A broad planning framework covering cash flows, asset allocation considerations, and timelines to guide investment decisions.

3. Financial Health Check-Up

Review of existing investments to identify gaps, diversification issues, or concentration risks—establishing a clear starting point.

4. Financial Modelling & Scenario Analysis

Illustrative modelling to demonstrate how different strategies and market scenarios may impact long-term outcomes—supporting realistic expectations and behavioural discipline.

5. Execution Through Mutual Fund Investments

Facilitation through suitable mutual fund schemes, including SIPs, STPs, or SWPs where appropriate, ensuring consistency and long-term participation.

All investments are executed strictly with client consent and regulatory disclosures.

6. Reporting, Review & Monitoring

Periodic reviews to track progress against objectives, with discussions around adjustments if goals, risk profiles, or circumstances change.

Client Discipline & Process Alignment

A structured approach is effective only when supported by client understanding and commitment. AKCJ Capital emphasises:

Long-term perspective

Avoidance of impulsive, market-driven decisions

Periodic review rather than frequent churn

This supports measured participation in financial markets, not speculation.

Looking Ahead

As India’s wealth management ecosystem evolves with greater emphasis on transparency, suitability, and investor awareness, AKCJ Capital aims to contribute through a process-led, compliant, and disciplined approach, grounded in professional ethics and experience.

Completing 25 years as a Chartered Accountant reinforces the belief that trust is built over time through discipline, integrity, and consistency. AKCJ Capital is an extension of this belief—supporting investors on their long-term wealth journey through structured processes, informed discussions, and responsible execution.

*Mutual fund investments are subject to market risks. Read all scheme-related documents carefully.