Why Asset Allocation Matters More Than Fund Selection

January 30, 2026

By Paul Joseph

Wealth Manager

When investors think about mutual fund investing, the first question they usually ask is, “Which is the best fund?” Rankings, recent returns, and star ratings often dominate decision-making. While fund selection has its role, focusing on it alone can be misleading. Over long periods, investment outcomes are influenced far more by asset allocation– how money is distributed across equity, debt, and other asset classes- than by choosing the “best” individual fund.

In simple terms, asset allocation defines the risk and return profile of a portfolio, while fund selection fine-tunes performance within that framework.

Asset Allocation Drives Portfolio Behaviour

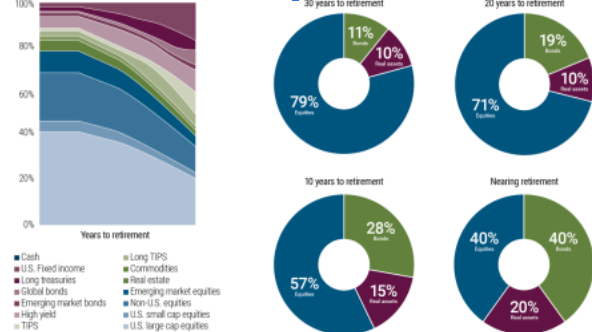

Decades of investment research across global markets show that asset allocation explains the majority of portfolio return variability, not security or fund selection. Whether a portfolio holds 70% equity or 40% equity has a much greater impact on long-term outcomes than choosing between two competent equity funds.

Equity provides growth but comes with volatility. Debt offers stability and liquidity. Low-volatility strategies such as arbitrage, and diversifiers like gold, help reduce portfolio stress during uncertain periods. The proportion in which these assets are combined determines how a portfolio behaves across market cycles- during rallies, corrections, and prolonged sideways phases.

Even the best-performing equity fund cannot offset a portfolio that is structurally misaligned with an investor’s risk tolerance or time horizon.

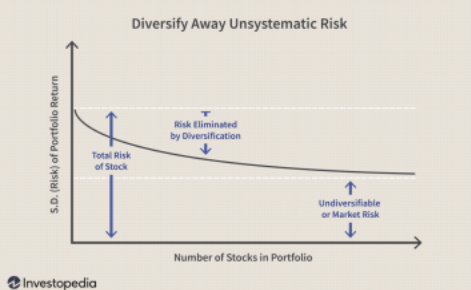

Risk Is a Portfolio Concept, not a Fund Label

Investors often ask whether a particular fund is “risky.” This framing is incomplete. Risk is meaningful only at the portfolio level, not at the level of an individual fund.

A mid-cap fund may appear risky on its own, but when it forms a limited allocation within a diversified portfolio that includes large-cap equity, debt, and low-volatility assets, the overall risk becomes intentional and manageable. Asset allocation ensures that drawdowns remain within acceptable limits- both financially and emotionally- reducing the likelihood of panic-driven decisions.

Structure Enables Behavioural Discipline

Most investors underperform not because of poor funds, but because of poor behaviour. Panic selling during market corrections, stopping SIPs after short-term underperformance, and chasing last year’s top funds are common mistakes.

A well-designed asset allocation acts as a behavioural anchor. When investors understand that volatility is expected in the equity portion of their portfolio- and that stability exists elsewhere- they are more likely to stay invested during stressful periods. In practice, a portfolio that an investor can stick with consistently often outperforms a theoretically superior portfolio that is frequently abandoned.

Asset Allocation Adapts Across Market Cycles

No asset class performs well in every environment. Equity leads during economic expansion, while debt provides protection during slowdowns or rate cycles. Low-volatility strategies help smooth transitions when markets are uncertain.

Asset allocation allows portfolios to adapt to changing conditions without constant fund switching or market timing. It reduces dependence on any single narrative- growth, inflation, interest rates, or global events- and ensures resilience across cycles. Fund selection plays a supporting role, but it cannot correct a flawed allocation.

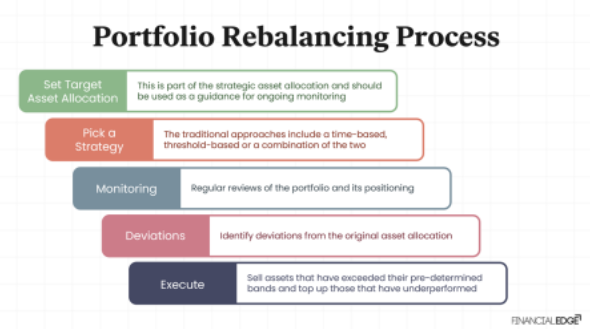

Rebalancing: The Quiet Advantage

Asset allocation is not static. Over time, market movements distort the original allocation as some assets outperform others. Rebalancing restores balance by trimming assets that have grown disproportionately and reallocating to those that are underrepresented.

This process enforces a disciplined “buy low, sell high” approach without relying on predictions or emotions. Over long periods, systematic rebalancing can significantly improve risk-adjusted returns while keeping portfolios aligned with investor goals.

Final Thought

Asset allocation may lack excitement, but it determines endurance. It governs risk, shapes behaviour, and allows compounding to work uninterrupted across market cycles. Fund selection matters- but only after the structure is right.

In investing, strong outcomes are built on sound structure. Asset allocation creates that structure; fund selection refines it.