Green Hydrogen: Powering the Path to a Sustainable Future

-Sarthak Nautiyal

(Assistant Manager, Investment & Research)

As the global community accelerates efforts to combat climate change, one transformative energy solution is emerging as a frontrunner: green hydrogen. Dubbed the “fuel of the future,” green hydrogen has the potential to decarbonize hard-to-abate sectors, stabilize energy grids, and reshape the energy economy. With countries, companies, and investors committing billions to its development, the green hydrogen revolution is no longer a distant dream but an imminent reality.

What is Green Hydrogen?

Green hydrogen is hydrogen produced through electrolysis powered by renewable energy sources like wind or solar. Unlike grey hydrogen (derived from fossil fuels) or blue hydrogen (produced with carbon capture technology), green hydrogen generates zero carbon emissions, making it a cornerstone of the sustainable energy landscape.

Why is Green Hydrogen Crucial?

1. Decarbonizing Hard-to-Abate Sectors: Industries like steel, cement, and aviation are difficult to electrify. Green hydrogen can replace fossil fuels in these sectors and power heavy-duty vehicles, ships, and trains.

2. Energy Storage and Grid Stability: Renewable energy is intermittent. Green hydrogen can store excess energy when supply exceeds demand, stabilizing grids and providing backup during shortages.

3. Global Hydrogen Economy: Countries like Japan, Germany, and Australia are investing billions into green hydrogen infrastructure, with global demand expected to grow from 90 million tonnes to 200 million tonnes by 2030.

Cost Decline Over Time

Despite its potential, green hydrogen currently costs $3–$6 per kilogram, compared to $1–$2 for grey hydrogen. However, costs are expected to decline to $1.5–$2 per kilogram by 2030 due to cheaper renewable energy, economies of scale, and technological advancements.

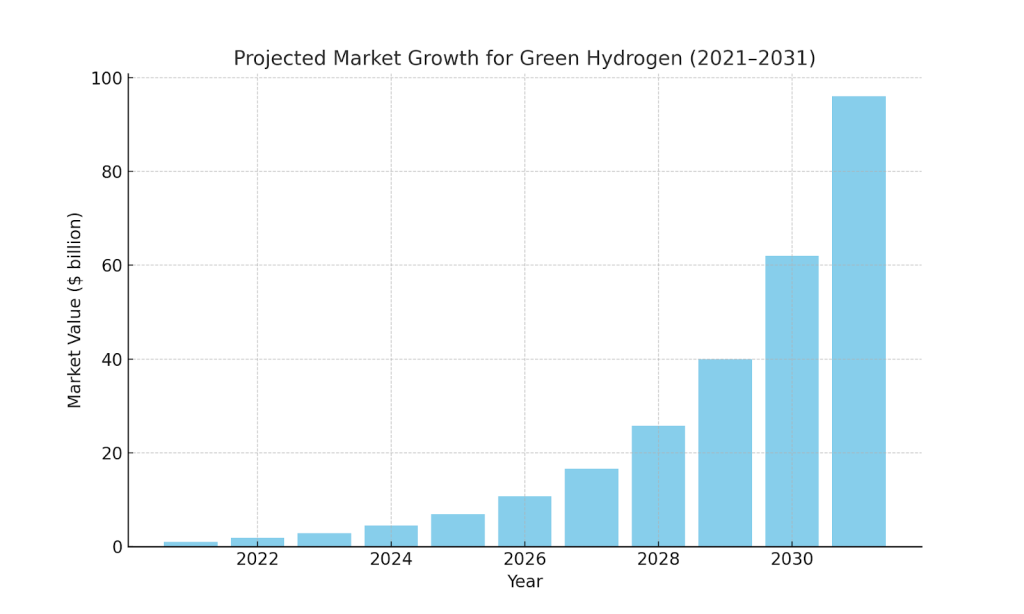

Market Growth Trajectory

The green hydrogen market, worth $1 billion today, is projected to grow at a CAGR of 55%, reaching $100 billion by 2031. This rapid expansion is driven by increasing investments, infrastructure development, and global decarbonization efforts.

Sectoral Impact

Green hydrogen’s versatility can revolutionize various sectors. Transport accounts for 40% of its emission reduction potential, followed by power at 35%, and heavy industry at 25%. This demonstrates its ability to integrate renewable energy with hard-to-abate sectors, creating synergies in the energy landscape.

Quantifying the Opportunity

Green hydrogen production is set to reach 50 million tonnes by 2030, supported by $500 billion in global investments. Energy giants like Shell and TotalEnergies are heavily investing, while countries such as Saudi Arabia and Australia are positioning themselves as leading suppliers. Saudi Arabia’s world-largest green hydrogen plant will commence by 2025, while Australia leverages its abundant renewables for export.

Why Invest Now?

First-Mover Advantage: Early investors in the hydrogen economy will benefit from rapid market expansion as governments incentivize adoption.

Long-Term Growth: Companies across the green hydrogen value chain—renewable energy providers, electrolyzer manufacturers, and hydrogen distribution firms—are poised for exponential growth. A diversified approach reduces risk while maximizing returns.

Conclusion

Green hydrogen is set to revolutionize the energy market and help achieve global climate goals. While challenges like high costs and infrastructure gaps remain, falling renewable prices and increasing investments suggest a bright future. Early investments over the next 3–5 years could yield significant returns as the world transitions to a carbon-free energy system.