India’s Union Budget 2026: Strategic Outlook for Investors

January 30, 2026

By Harshul Chopra

Assistant Manager

The 2026–27 Union Budget of India arrives at a crucial inflection point — an era where growth momentum remains robust, but macroeconomic headwinds and evolving global trade dynamics pose both challenges and opportunities for markets and investors.

This newsletter synthesises verified economic data and pre-budget expectations to provide an informed, forward-looking analysis of investment themes across asset classes and key sectors, and how budgetary policy could influence them.

Macroeconomic Backdrop: Growth, Deficits, and Fiscal Momentum

Economic Growth Trends

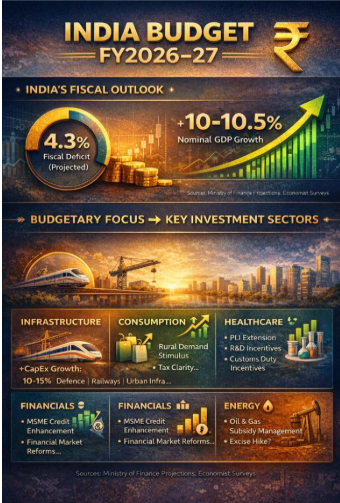

- Real GDP for FY2025–26 is projected at ~7.4%, driven by consumption, services, and manufacturing recovery — a notable improvement from 6.5% in FY2024–25.

- Nominal GDP — the base for revenue and fiscal assumptions — is anticipated to grow ~8–10.5% in FY2026–27 according to economist surveys.

- International institutions like the IMF estimate real growth at ~6.6% for FY2025–26, affirming India’s position among the fastest-growing major economies.

These figures imply expanding economic activity, which underpins revenue estimates and fiscal planning.

Budgetary Deficit & Fiscal Strategy

- The fiscal deficit is widely expected to remain near current levels (~4.2–4.3% of GDP) in FY2027, reflecting a balance of growth stimulus and fiscal prudence.

- Ongoing policy signals also point to medium-term debt consolidation with continued capital expenditure emphasis.

Investor Takeaway: A stable fiscal glidepath with targeted deficit moderation supports investor confidence and may anchor Indian sovereign credit valuations.

Sectoral Investment Outlook: Expectations & Budget Impacts

Below we analyse key sectors, major investment drivers, risks, and potential budgetary implications.

- Infrastructure & Capital Goods

Outlook: Positive → Strong Policy Support

- Public capital expenditure is forecasted to grow 10–15% over FY2025–26 levels, reinforcing infrastructure engines like railways and roads.

- Transport infrastructure investments reduce logistics costs (currently ~7.9% of GDP) and expand project pipelines.

Potential Budget Measures

- Increased allocations for rail safety and signalling, urban transport, and rural connectivity.

- Strategic focus on defence and shipbuilding capex.

Implications for Investors

- Capex-linked equities (capital goods, engineering), select infrastructure funds/ETFs, and project finance instruments could see sustained flows.

- Public-private partnerships may receive renewed momentum.

- Consumption & Consumer Staples

Outlook: Moderately Positive

- Private consumption remains the dominant GDP driver, underpinned by improving rural incomes and services demand.

- Any rural demand stimulus or tax clarity on goods and services could further lift staples and discretionary spending.

Budgetary Levers

- Rural infrastructure schemes, direct benefit enhancements, or targeted demand incentives.

- Clarity on duties and surtaxes for consumer products.

Implications

- Select consumer staples stocks may benefit from consumption stability.

- Discretionary sectors (retail, lifestyle) are likely sensitive to tax incentives and demand boosts.

- Automotive & Electric Mobility

Outlook: Neutral to Positive

- Recent GST cuts already supported auto sales stability. Expectations of no significant direct tax incentives may temper near-term impetus.

- Budgetary emphasis could shift toward EV charging infrastructure and localisation, rather than purchase subsidies.

Investment Signals

- Capital equipment and electrical infrastructure firms could benefit from EV ecosystem investments.

- Traditional OEMs may see mixed reactions depending on rural demand kick starters.

- Healthcare & Pharmaceutical

Outlook: Moderately Positive

- Industry participants typically seek extended PLI schemes for APIs, R&D incentives, and import duty rationalisation for high-end equipment.

Budget Expectations

- Enhanced manufacturing incentives, customs duty adjustments, and support for diagnostics infrastructure.

Investor Implications

- Pharmaceuticals with strong domestic manufacturing footprints and large hospital chains may benefit.

- MedTech firms could see improved equipment adoption economics.

- Oil & Gas

Outlook: Mixed

- Relative stability in energy prices allows for controlled subsidy outlays but may also invite higher fuel excise rates to support fiscal metrics.

- This potentially compresses marketing margins for OMCs despite stable demand.

Investment Consideration

- Refinery integration and petrochemical diversification remain key hedges against excise-driven margin pressure.

- Financials & Credit Markets

Outlook: Positive for Credit Demand, Cautious on Spread

- Banks and NBFCs benefit from sustained credit growth and consumption cycles.

- Budget focus on rural credit and MSMEs can enhance loan growth pipelines.

Policy Impact

- Enhanced credit guarantees, MSME tax reliefs, or securitisation incentives could deepen financial market participation.

- Equities & Market Sentiment

Stock Market Expectations

- Markets are pricing in no major reforms, focusing instead on stability, capex, and modest demand stimulus.

Investor Sentiment

- Stability-centric budgets generally support risk assets but require clear growth levers to sustain long risk cycles.

Broader Investment Themes for FY27 | |||||||||||||||||||||

|

Note: The overall direction depends on both macro assumptions like nominal GDP growth (expected ~10–10.5%) and fiscal deficit frameworks underlying tax and spend projections.

Final Thoughts for Investors

The 2026–27 Budget is likely to strike a balance between fiscal discipline and growth orientation. With India’s economic growth momentum intact, capital expenditure continuing as a cornerstone, and consumption demand gradually strengthening, the budget outcome could shape asset allocation strategies across sectors.

Key strategic priorities for investors:

- Lean toward capex-linked sectors and financials that benefit from broad economic activity.

- Monitor policy signals on taxation, rural demand, and EV infrastructure for sector rotation opportunities.

- Stay attentive to fiscal deficit controls and revenue assumptions shaping market risk sentiment.